How to Know if You Can Get a Mortgage

Mortgage approving: Who gets information technology, and who doesn't?

Figuring out whether you will exist approved for a mortgage is a curious process. It turns out that a big banking concern account and even a high credit score may non be enough to seal the deal.

Well-nigh mortgage applicants do get loan approval

At first this seems backwards, because more than money in the bank sounds similar a sure path to mortgage approving. And when it comes to credit scores, higher is always improve, right?

Not quite.

Lenders are concerned nigh the balance of risk and advantage. In an ideal situation, lenders like to see no take a chance, only in practice they have to deal with the real globe. As this is written that means interest rates around 4 pct and borrowers who finance with little down.

How long does information technology take to get pre-approved for a mortgage?

According to Ellie Mae, equally of July 2017, mortgage lenders approved seventy.6 per centum of loan applications started during the previous 90 days. This does not mean 29.4 percent of all the remaining applications failed. Some may accept begun late in the cycle, and are still being processed. Other borrowers started with i lender and switched to another.

However, this also means loan approvals are non automated.

Does money actually talk?

Only what about large money and high credit scores? Don't they ever mean instant mortgage approvals?

With big money, the consequence is oft large expenses. If yous brand $75,000 a year, simply accept $25,000 in credit carte du jour balances, $60,000 in educatee loans, and $30,000 in machine loans, y'all'll make lenders wince.

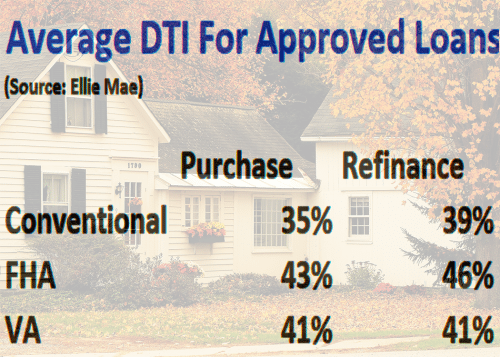

Your debt-to-income (DTI) ratio can tell you how much dwelling to buy

If a lender allows as much as 43 percent of your gross monthly income for debts (this is your debt–to–income ratio or DTI), it means you can spend $ii,687 on credit carte bills, car payments, student debts, and housing costs.

The chart below shows the average DTI of approved loans according to Ellie Mae:

With $25,000 in credit card balances, you lot might be required to repay ii percent of the outstanding debt, a full of $500 a calendar month. Add in one percent for student debt ($600 a month) and a $475 monthly cost for an SUV, and that leaves $1,112 for housing– a number that won't work for many borrowers.

Exercise you get credit for proficient credit?

With high credit scores – say 740 or in a higher place – borrowers are surely attractive to lenders. And yet, some mortgage applicants with solid credit cannot go financing. The issues here can include insufficient downwards–payment money, low appraisals, and inadequate monthly income.

What'due south the existent credit score needed to become approved for a mortgage?

(In other words, it'due south possible to have a potent credit score with a small income, and that income may not exist plenty to support a mortgage application.)

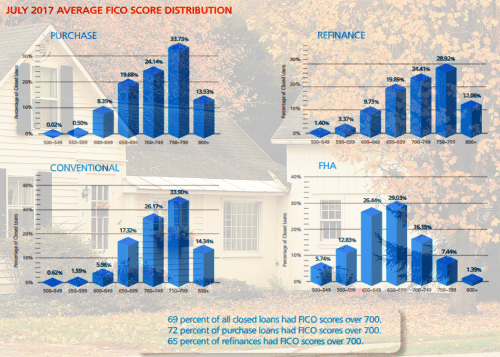

The illustration below shows the average FICO scores for those who got mortgages in July 2017, according to Ellie Mae. You lot can meet that while it's possible to get approved with very low FICO scores, it doesn't happen that often.

Downwardly payment: How much do y'all need?

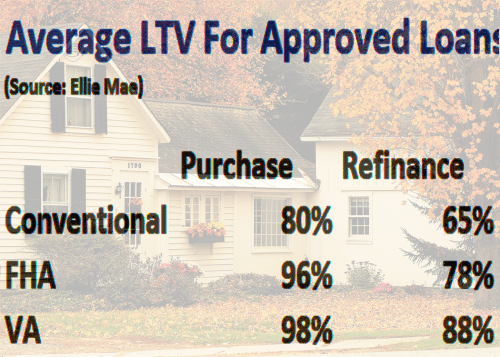

Many loans allow low–to–no downwardly payments, including FHA (3.5 percent), VA (zero), USDA (zip) and conforming (3–5 percent).

You don't need 20 percent downwardly to purchase a home

However, to go a loan with a low down payment that is not government–backed or with income limits for eligibility, you'll need to showtime that risk with good credit or a low DTI.

Fannie Mae, for example, requires either a 680 FICO and a DTI of 36 percent or lower, or a 700 FICO an a DTI of 45 per centum or lower.

How to get approved for a mortgage

You don't have to be a financial home–run hitter to become a mortgage. Withal, yous do take to fit inside the arrangement. Here are 5 steps y'all can take to successfully navigate the lending mural.

1. Save

"As average wage hikes beyond the U.S. continue to lag increases in spending," reports United states Today, "Americans are saving less or dipping into bank accounts to fuel their outlays."

The lowdown on down payment grants

Beat out the crowd and save. More money in the depository financial institution gives you lot the opportunity to accept a larger down payment and bigger greenbacks reserves, measures lenders like to see.

2. Cut spending

Harvard economist Juliet B. Shor in The Overspent American argues that America possesses "a culture where spending has go the ultimate social art." For lenders, too much spending is an instant no–no, a way to violate debt–to–income ratios that cannot exist overcome.

Likewise much debt? Here'due south your programme

Cutting spending prior to your home purchase allows y'all to do one of 2 things:

- direct more of your monthly income to savings for your down payment, closing costs and reserves

- direct more of your monthly income to paying down your debts

Either of those things will increase your chances of mortgage blessing, and volition improve your finances as well.

three. Gather your papers

Since the stop of the housing crisis, lenders have been careful to fully certificate loan applications. The reason is that lenders must recoup investors if a mortgage goes bad because of poor underwriting. They can lose authorities approval to fund FHA, VA or USDA home loans.

In some cases, lenders are penalized fifty-fifty if a loan file is wrong just the mortgage is non foreclosed. For borrowers, this means you must have in paw such things as tax returns, pay stubs, business relationship statements.

4. Give it a rest

Once you utilize for a mortgage, information technology may seem as though the process is consummate. You've done your part. Not and so – as your awarding winds its way through the underwriting process, it's probable that your credit written report will be checked and re–checked.

The event is that a big purchase it can suddenly reduce your our ability to get a loan. At the very to the lowest degree, your application will go back into underwriting. The lender will recalculate your DTI. Your loan terms may modify, and yous may miss your closing date.

eight ways to get a mortgage approved (and not mess it up)

Until the loan closes, it's best to maintain a quiet catamenia where you hold spending to the minimum and don't open whatever new credit accounts. According to a 2013 study by Equifax, "almost one–fifth of all mortgage borrowers, including those with solid credit scores and debt–to income (DTI) ratios, employ for at to the lowest degree one new trade line during this period. Many borrowers just don't realize how this new 'undisclosed debt' impacts their ability to qualify for their mortgage."

5. Stay in contact

Yous want to stay in touch on with your loan officer to assure no papers are missing, and that the application is proceeding on schedule. Whatsoever time yous send or fax documents, follow upwardly to make sure they got to the right person.

What are today's mortgage rates?

Today'south mortgage rates are seriously depression. Lower rates can assistance with your loan approving by making your home more affordable. To get the lowest rate to which you're entitled, programme on shopping and comparing offers from several competing mortgage lenders. That'due south easy to do right here.

The data independent on The Mortgage Reports website is for informational purposes merely and is not an advertisement for products offered past Full Chalice. The views and opinions expressed herein are those of the author and practise not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Source: https://themortgagereports.com/31642/how-do-i-know-that-ill-be-approved-for-a-mortgage

0 Response to "How to Know if You Can Get a Mortgage"

Post a Comment